The 9-Minute Rule for Investment Representative

Wiki Article

About Ia Wealth Management

Table of ContentsThe Best Guide To Independent Financial Advisor CanadaThe Main Principles Of Independent Financial Advisor Canada The Best Strategy To Use For Independent Investment Advisor CanadaEverything about Tax Planning CanadaRetirement Planning Canada - The FactsExcitement About Investment Representative

“If you're purchasing a product or service, state a tv or a pc, you might want to know the specifications of itwhat tend to be their parts and exactly what it may do,” Purda details. “You can remember purchasing financial advice and support in the same manner. Folks have to know what they are getting.” With economic advice, it’s important to keep in mind that the product is not ties, shares or any other opportunities.It’s things such as cost management, planning retirement or paying down debt. And like buying some type of computer from a trusted organization, customers need to know these are generally buying economic information from a dependable pro. Certainly one of Purda and Ashworth’s best findings is around the charges that economic coordinators demand their customers.

This conducted correct irrespective of the cost structurehourly, fee, possessions under control or flat fee (from inside the research, the dollar value of fees ended up being the exact same in each instance). “It nevertheless comes down to the value idea and doubt on the consumers’ component they don’t determine what they're getting into change for these charges,” says Purda.

The 8-Minute Rule for Independent Financial Advisor Canada

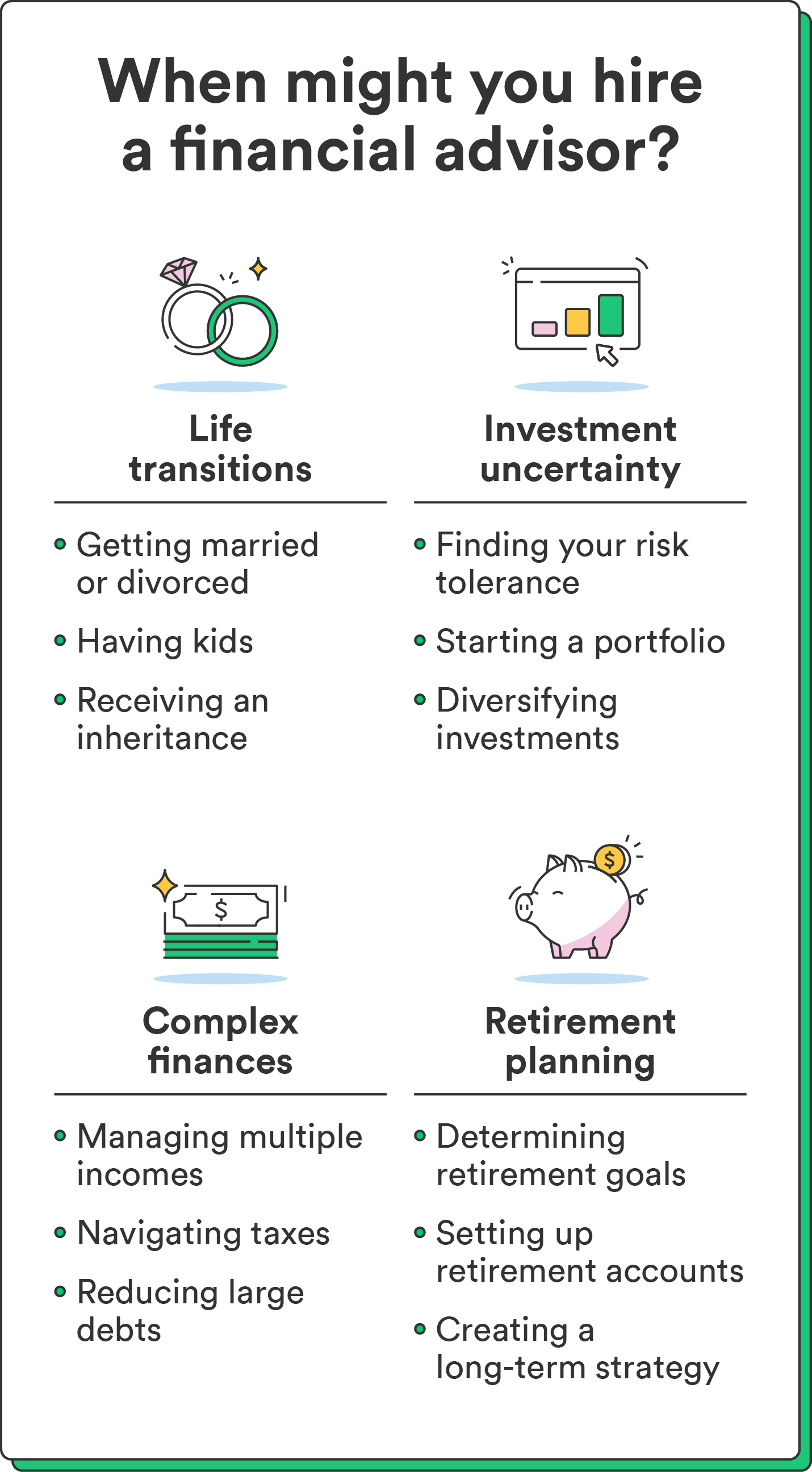

Tune in to this article whenever you listen to the expression financial consultant, just what comes to mind? Many people contemplate a specialist who is able to let them have monetary advice, especially when you are considering investing. That’s the starting point, however it doesn’t decorate the complete image. Not even close! Economic experts will help individuals with a lot of some other money objectives also.

An economic expert will allow you to build wealth and shield it when it comes down to longterm. Capable calculate your own future monetary needs and plan approaches to stretch the pension savings. They could in addition help you on when to begin tapping into personal safety and using the income inside your retirement records so you're able to avoid any nasty penalties.

Fascination About Independent Investment Advisor Canada

They may be able help you figure out just what shared funds are best for your needs and explain to you just how to control and also make the absolute most of one's investments. They may be able also assist you to comprehend the threats and just what you’ll ought to do to accomplish your aims. An experienced financial investment professional will also help you remain on the roller coaster of investingeven when your assets take a dive.

They may be able provide direction you will need to produce a plan in order to ensure your desires are carried out. While can’t put a cost label regarding peace of mind that include that. In accordance with research conducted recently, an average 65-year-old few in 2022 should have around $315,000 saved to cover medical care prices in pension.

All About Investment Consultant

Since we’ve reviewed exactly what economic experts carry out, let’s dig inside differing types. Here’s a great rule of thumb: All economic planners are financial advisors, yet not all experts tend to be planners - https://worldcosplay.net/member/1710866. A financial planner centers around helping individuals generate intentions to reach long-term goalsthings like starting a college account or conserving for a down repayment on property

Exactly how do you know which financial advisor suits you - https://dribbble.com/lighthousewm/about? Check out steps you can take to make certain you are really employing ideal individual. Where do you turn when you've got two poor options to pick from? Easy! Get A Hold Of even more possibilities. More solutions you may have, the much more likely you happen to be which will make an effective choice

How Lighthouse Wealth Management can Save You Time, Stress, and Money.

Our very own Smart, Vestor plan causes it to be easy for you by showing you doing five economic experts who are able to last. The best part click for source is actually, it's completely free to have linked to an advisor! And don’t forget about to come calmly to the meeting ready with a list of concerns to inquire of so you can determine if they’re a good fit.But listen, just because a consultant is wiser than the average keep doesn’t provide them with the ability to show what direction to go. Occasionally, experts are loaded with themselves simply because they have significantly more degrees than a thermometer. If an advisor starts talking-down for you, it’s time to show them the entranceway.

Just remember that ,! It’s essential along with your financial advisor (the person who it ultimately ends up becoming) take the same web page. You need an advisor who's got a long-term investing strategysomeone who’ll convince one keep spending consistently perhaps the marketplace is up or down. ia wealth management. You also don’t like to utilize somebody who forces one to invest in a thing that’s too high-risk or you’re uncomfortable with

The Best Guide To Private Wealth Management Canada

That blend will give you the variation you'll want to successfully invest for long term. Just like you research monetary analysts, you’ll probably run into the word fiduciary duty. All this work suggests is actually any consultant you employ needs to act in a way that benefits their particular client and not their own self-interest.Report this wiki page